Credit Scores, Credit Reports and Credit Checks - The Definitive 2023 New Zealand Guide

We explain your Credit Score and how to improve it, as well as how lenders credit check you. Our guide explains how to request your FREE Credit Report, as well as answering the most common queries about credit scoring and rating.

Updated 17 November 2023

Summary of Credit Scores and Credit Reports

If you want to get a free credit report right now, we suggest visiting:

This guide covers:

Additional Insights:

- Four credit reference agencies provide free credit reports and/or scores; you'll wait between 60 seconds and 20 working days to get them

- A credit report and credit score don't decide whether you'll be accepted for a loan - the personal details in your application play a significant part.

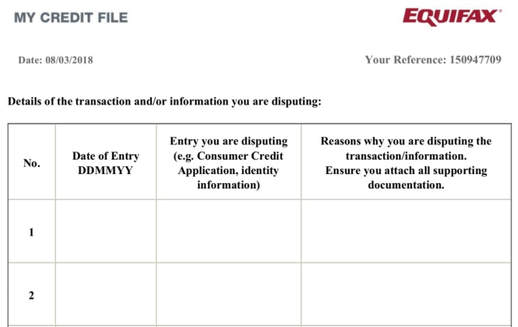

- Credit reports include positive and negative credit history, and it will stay on your file for up to five years. It's a good idea to challenge anything that isn't correct quickly - it's your responsibility to make sure your credit records are accurate.

- We've listed 15+ ways to improve your credit score - many of these are quick wins and will help you in the short and long term.

If you want to get a free credit report right now, we suggest visiting:

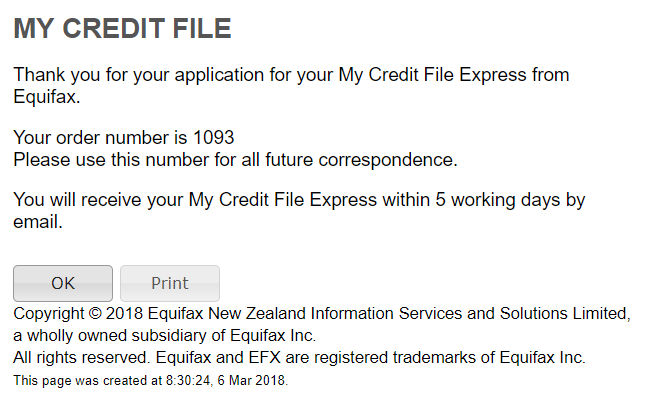

- Equifax - the credit reference agency used by almost every major bank, Equifax offers a free credit report (10 working days) or an express credit report (delivered in 3 working days or less). Visit the Equifax website to apply

- illion - the second most popular credit reference agency, illion offers a range of credit report services, with a fast-track credit report (3 days delivery) and a free standard credit report (10-20 working days delivery) being the most popular. Visit the illion website to apply.

- Centrix - a free credit report is provided in 5-10 days - visit the Centrix website to apply.

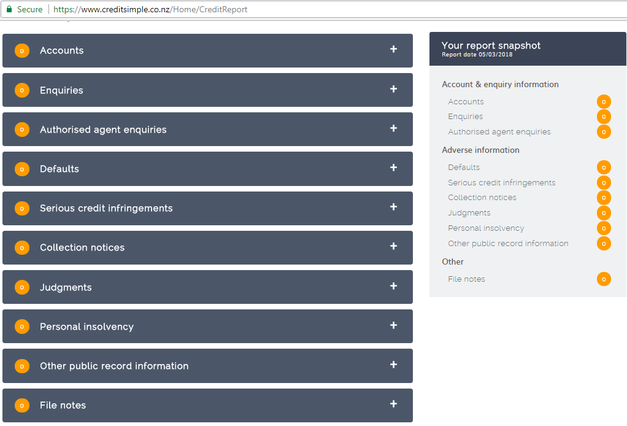

- Credit Simple offers a free credit score (not a credit report) which may be helpful as a background document. Visit the Credit Simple website to apply.

This guide covers:

- What Is A Credit Score, Credit Report And Credit Rating?

- 10 Must Know Facts About Credit Scores, Credit Reports And Credit Applications

- What Lenders Know About You (And How They Make A Decision)

- How To Get A Free Credit Report And Credit Check

- 15+ Tips To Improve Your Credit Score

Additional Insights:

MoneyHub Founder Christopher Walsh shares his views on credit scores and what lenders look at:

|

"I believe that credit history is not just relevant for mortgages, loans and credit cards. It also influences what you'll be offered when it comes to applying for electricity, bank accounts, phone contracts, insurance and car finance".

"Generally, the rule is the better your credit history, the more options you'll be offered by way of credit. In New Zealand, credit scores, credit reports and the process of a credit check are largely misunderstood by the general public. Therefore, I argue that having a history of reliability (e.g. always paying back your debts) is the strongest sign of good credit". "This guide is designed to explain everything you need to know about credit scores, checks and ratings. We've also included several easy-to-action tips on how to increase your credit score in the short term and ongoing". |

MoneyHub Founder

Christopher Walsh |

|

How to apply for a Free Credit Report:

|

Unlock Savings with MoneyHub's Trusted Personal Loans - Avoid exorbitant interest rates and hefty fees.

- Our research has identified Simplify Loans (car loans only), Harmoney and/or First Credit Union as standout lenders renowned for offering competitive interest rates to many borrowers.

- A quick, few-minute application could be your first step towards significant savings.

- Important: While we may receive a commission for loans taken out, our recommendations are unbiased and solely focused on your financial benefit.

- Interest rates are personalised, so check what these top lenders can offer you.

- Remember, the interest rate you lock in today can lead to substantial savings in your loan repayment journey. With any personal loan, the potential to save is immense with the right loan interest rate and terms.

- Please take your time, compare wisely, and avoid the typical loan traps by knowing what you'll pay upfront.

Making Credit Clear - What is a credit score, credit report and credit rating?

There has been a lot of confusion when it comes to individual credit scoring, with a lot of wrong information being circulated throughout New Zealand adding to the misconceptions. And because lenders have no incentive to make credit scoring understood (doing so would give consumers more power), we've taken care to put together information that walks Kiwis through the ins and outs of credit scoring.

First, let's define some terms you're likely to have heard of:

First, let's define some terms you're likely to have heard of:

- Credit History and Credit File: This is a comprehensive list of all of your transactions relating to credit. For example, loans you've taken out and repaid, credit card payments, mortgage information, phone contracts and everything that involves some form of borrowing.

- Credit Report: Your credit report is a summary of your credit history, which usually includes a credit score (see below). It's used by lenders when they assess your suitability for a loan or some other form of credit.

- Credit Score: This is a single number which is based on your credit history - in a way it sums up your credit report into one number.

- Creditworthiness: This is an evaluation performed by a lender to work out if you're likely to default on a debt, and it's based on credit history and current income.

- Credit Rating: This is not a popular term, but in essence is similar to creditworthiness.

- Credit Reference Agencies: These are companies who collect credit data about you and supply it to lenders when you make a credit application. The main credit reference agencies operating in New Zealand are Equifax, illion and Centrix

- Credit Score Providers: These are companies who provide credit scores using the data from one or more Credit Reference Agency. In New Zealand there is one - Credit Simple.

10 Must Know Facts About Credit Scores, Credit Reports and Credit Applications

New Zealand doesn’t have a credit score “blacklist”, but individual lenders mayNationally, there is no "blacklist" - there are no facts to prove this. A credit score is a range (for example, Credit Simple scores you between 0 and 1000) and there is no threshold for a “blacklist”. Further to that, there is no list of banned people. If you’ve previously defaulted on loans, credit card and/or phone contracts, your credit score will be low but you won’t appear on any so-called blacklist, nor will you be banned from applying for new credit.

But - a lender may have a "bad customer" file If you've defaulted before, it's likely your lender has put you on an internal naughty list. While no lenders will publicly confirm they operate blacklists, it's widely understood they do as a way to protect themselves from further bad debt. So if you've had trouble with one lender in the past, it could be an idea to apply for credit with another lender. |

Your credit data comes from information supplied by lenders and other companies all over New ZealandWhenever you have a form of credit, how you behave is recorded and reported to at least one of three credit reference agencies. Since 2012, many lenders have been engaged in "positive reporting", also known as "comprehensive credit reporting". What is means is that BOTH positive and negative data is reported. For example, negative instances of defaults on debt, missed payments and bankruptcies appear alongside positive instances such as on-time payments and overpayments.

Whenever you're late on a bill it will be included in your credit file, so be aware that this could make it harder for when it comes to making another credit application down the line. |

Every lender evaluates you differently, and they won’t share the results with youEvery company in New Zealand scores individuals differently when it comes to assessing their overall creditworthiness. They’ll use different credit report agencies, and they’ll have their own methods of saying “yes” or “no” to your application for credit.

To ensure the best possible credit assessment of potential customers, no lender will share any details of how they assess you – doing so could risk individuals gaming the system on future applications. For example, Vodafone doesn’t want customers who can’t afford an iPhone plan to be approved for a contract. When you apply, you will only hear the final decision, and not the evidence used to make the decision. |

Understand why you may be rejected...and know there are usually other optionsIf you have a history of missing payments, or have defaulted, you are more likely to be rejected when applying for new credit. It’s not personal, it’s simply lenders minimising their risk of unpaid debts.

For example, if your friend had a bad history of repaying loans, would you lend to him? Probably not. Just because you’ve been rejected doesn’t mean all is lost. You can apply with another provider, although specialist firms offer finance to individuals with “bad credit”, although they consistently charge higher interest rates than standard lenders. |

The information in your application is VERY importantYour credit history and overall credit score isn’t the only factor in weighing up an application. What you’ve included in your application is also relevant, such as income, debts, your expenses and property you own. Also, if you’ve had a relationship with the company before this will also help give them a complete picture of you.

|

The purpose of credit scoring is to predict future behaviourIf you don’t have a credit history, then it is much harder to have a credit score. But if you’ve had a phone contract and/or a credit card, you’ll have some credit history data. A credit check analyses all of your data hoping to predict how you will behave in the future. It’s not a science but only an estimate, which has varying degrees of accuracy. The more information available, the more accurate the estimate will be.

|

Building your credit history is very importantOur Build a Credit History guide sets out best practices and easy to follow tips to establish yourself in the credit environment. It’s aimed at young people and people new to living in New Zealand, but the principles apply to anyone wanting to build a credit history.

|

Lenders have the right to reject good credit scoring applicantsLenders are motivated by profits as much as they are about minimising risk. It’s a low probability, but also it's not unheard of for people with excellent credit to be rejected from credit cards, probably because they always pay off their balances. The most profitable credit card customers are those who are stuck in debt, meeting the minimum payment month-on-month and incurring 20%+ returns for the bank on the balance owed.

Banks like to bring you in fresh and have you for as long as possible. There may not be much profit for them in a no-fees account, but credit cards, personal loans and mortgages can be lucrative for a bank if you have longstanding arrangements. For this reason, owning a house debt free and having large cash savings may not make you as valuable to a bank as you may think you are. |

Serial balance transfers can have a negative effectIf you’re a regular user of balance transfer credit card offers, your applications will show on a credit report. If you incur debt and promptly transfer it to another provider, you’re not a profitable customer for anyone. While balance transfers are good for lowering interest expenses, doing too many could be a red flag to lenders. But remember, credit scoring is secretive so it’s impossible to know for sure how one application today affects another later down the road.

See our balance transfer credit cards guide which highlights the cards with the longest 0% period. |

Revealed - What Lenders Know About You (And How They Make a Decision)

To ensure you appear as attractive as possible to a lender, it’s essential to understand how lenders make their decision. In every assessment, your credit score is only one factor – your application and history with the lender are both very important.

1. Your Application Form

This is potentially the most important factor in any application for credit. In this form, you’ll submit the most sensitive details. This includes your salary, your job title, your employer, your phone number, your address, whether you own or rent your home, your expenses, your debts, your dependents, your assets and the reason(s) for your application. You’ll need to be precise with the details, and make sure everything is accurate – don’t miss a zero or add one by accident. Lenders are assessing your affordability with every detail.

2. Your Past Relationship with the lender

Companies retain data on all customers, current and former, which means any past experience with the lender will be factored in to determine your suitability for whatever you’re applying for now. If you’ve not been a good customer, you may find it more problematic to be accepted - you may also find yourself on your lender's internal blacklist. Conversely, this also means that for individuals with little or no credit history, their existing bank could be more likely to accept applications than other banks who don’t have the customer data.

3. Your Credit Score with Equifax, illion, Credit Simple and Centrix

The four New Zealand credit reference agencies all work in a similar way – they analyse data and send individual credit reports to any company requesting one. All lenders use at least one agency when they assess your file. This data comes from seven main data points:

- Electoral roll information: This is publicly available and contains address and residence details.

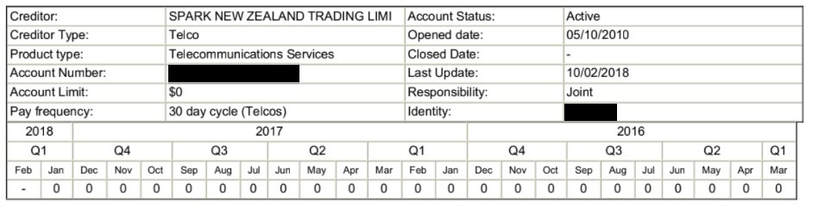

- Account data from previous behaviour: Banks, finance companies, electricity companies and other businesses use credit reference agencies to share your account behaviour. If you’ve been late or defaulted on a payment, this will be added to your file and ultimately negatively affect your credit score. A default is defined as a missed payment, overdue for 30+ days. Even if you have made payment in full after the 30 days, the default stays on your records. At any time, your credit data will show what types of credit you currently have, the credit limit, and the name of the lender.

- Debt Collections: If you've been chased by debt collectors for defaulting on a line of credit, this will be included even if you're repaid the balance in full.

- Hardship Applications: if you've applied for a financial hardship consideration to any lender, this will be included.

- Court records: Have you had a court judgment made against you for unpaid debts? If so, this information will be collected and added to your credit file. If you’ve been petitioned for bankruptcy or under financial restrictions imposed by the Official Assignee, your history will be included. The purpose of court information is to indicate whether you have serious debt problems.

- Payday Loan applications: A history of applications and/or loans from payday lenders may be a red flag to potential lenders. This is because payday loans are high-interest finance which is seen as a last resort, and suggest you may be a risky borrower.

- Credit Search data: Your records show any other lenders who have accessed your file, so if you’ve applied for lots of loans or credit cards, this will be evident on your history.

4. Challenging the fears – what is NOT on your credit file

Many people think everything is on their credit file, so we’ve made a list to disprove the misinformation about what’s not so you can focus better on improving your credit score.

- Student loans - unless you've defaulted on repayments.

- Who you're married to or living with - unless you're linked financially to another person, there's no information about who you live with and members of your family.

- Declined applications - lenders don't see if you have been successful when applying for credit, but if you've been refused on more than one occasion and applied at other lenders, this will be obvious to see as it will contain a number of credit inquiries.

- Parking and speeding tickets - speeding ticket are outright excluded, and, generally, parking tickets from private companies are not recorded on your file unless the debt is so great that it has been passed on to Baycorp or a similar agency - our guide to private parking tickets explains in more detail.

- Defaults or missed payments beyond five years - the limit of data is five year, so if you missed an electricity payment back in 2008 your file wouldn't include that.

- Whether you've requested your own credit file - you see this, but lenders don't so there's no limit on how many times you can request it.

- Race, religion, marital status, ethnicity.

- Salary - but this will be a key question in any application for credit.

- Savings accounts and investments - savings and investments are not credit products so are irrelevant to credit data, but you'll usually be asked to provide such information on an application.

- Medical history - any medical conditions you have or have had are not listed.

- Criminal record - any convictions are not listed.

- Child Support payments - any data from WINZ is excluded.

5. Your credit report 'influences' if you’ll be approved, and what interest rate you’ll get

It's important to re-emphasise that a credit report serves to assist lenders making a decision, it doesn't make the decision for them. Your application is the most important - if you can't afford what you are applying for, the credit data won't matter.

Your credit report does influence what interest rate you will be offered. You’ll see interest rates “from 6.99%” from banks and lenders like Harmoney, GEM Finance and Squirrel. However, what you’ll actually pay will be determined by your credit assessment. If you see an attractive interest rate offer, don’t be certain you’ll get it – most people don’t. In fact, the 6.99% offer you see advertised may only be offered to 10% of applicants, i.e. the ones with the best credit profile. It’s not a human right to be lent money, and the market rates are decided by the finance industry who wants to ensure they’re not losing money lending to people who can’t repay.

If you don’t like the terms you’re offered, your only choices are to accept the offer or make an application with another lender.

Your credit report does influence what interest rate you will be offered. You’ll see interest rates “from 6.99%” from banks and lenders like Harmoney, GEM Finance and Squirrel. However, what you’ll actually pay will be determined by your credit assessment. If you see an attractive interest rate offer, don’t be certain you’ll get it – most people don’t. In fact, the 6.99% offer you see advertised may only be offered to 10% of applicants, i.e. the ones with the best credit profile. It’s not a human right to be lent money, and the market rates are decided by the finance industry who wants to ensure they’re not losing money lending to people who can’t repay.

If you don’t like the terms you’re offered, your only choices are to accept the offer or make an application with another lender.

How to Get a FREE Credit Report and Credit Check

There are four options available, and all of them are free. We'd suggest applying with Credit Simple for its ease of use, followed by Equifax given the number of lenders who use it. If you notice anything that looks unusual, raise it urgently with the credit reference agency and follow it up until it's cleared and/or resolved.

How to apply for a Credit Report

- Equifax - the credit reference agency used by almost every major bank, Equifax offers a free credit report (10 working days) or an express credit report (delivered in 3 working days or less). Visit the Equifax website to apply

- illion - the second most popular credit reference agency, illion offers a range of credit report services, with a fast-track credit report (3 days delivery) and a free standard credit report (10-20 working days delivery) being the most popular. Visit the illion website to apply.

- Centrix - a free credit report is provided in 5-10 days - visit the Centrix website to apply.

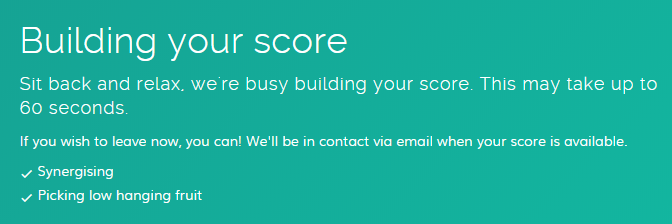

How to Apply to Get Your Credit Score

- Credit Simple offers the only free credit score service in New Zealand. It's quick and perfect for a summary of your credit data. Credit Simple is owned by illion, formerly Dun & Bradstreet, and pulls its data from there.

- To get a credit score, log on to the Credit Simple website and register. You don't need a credit card to sign up, and Credit Simple advertises that the service is free, and will always be free.

- You'll need your driver's licence number and version, as well as personal details such as address, age, name and other minor details.

- You won't need to put in bank account details.

- Once you've completed the data fields, Credit Simple will build your score.

- You will receive a score in about 60 seconds, and a summary credit report which will list any defaults, defaults or late payments. You can challenge anything with Credit Simple if you don't believe your credit report is accurate.

15+ Tips to Improve your Credit Score and Credit Rating

Each lender assesses and scores you differently, and there is no transparency in what they actually prioritise. Despite all the inconsistency and uncertainty, there are many simple things you can do to reduce the risk of credit rejection and/or higher interest rates being offered. We’ve outlined 17 tips below to help boost your credit rating.

It’s important to remember that each lender has its own criteria for specific products; you may meet one bank’s loan criteria, but not another even if they’re offering similar rates and terms.

To have the best chance of securing credit you’ll need to be "attractive” to lenders – this means you’ll be low risk with a healthy cash flow to meet payments. The tips outlined below help lenders see you in the best light:

It’s important to remember that each lender has its own criteria for specific products; you may meet one bank’s loan criteria, but not another even if they’re offering similar rates and terms.

To have the best chance of securing credit you’ll need to be "attractive” to lenders – this means you’ll be low risk with a healthy cash flow to meet payments. The tips outlined below help lenders see you in the best light:

Check your credit file every year, and before you make any major applicationYour credit report files hold all your credit data but it’s up to you to make sure what is on file is accurate. If there is a mistake on your record, you need to fix it so that it doesn’t affect applications. It’s worth investing the time to check the files as all four credit agencies, as different lenders use different agencies when requesting credit data to help assist their credit assessment process. It’s likely information will vary depending on the agency.

|

Register to vote to get yourself verifiedIt’s really important to be on the electoral roll, so if you haven’t signed up, enrol now. Don’t wait to be signed up around election time – do it today. The process identifies you, your address and your employment. Even if the credit agency doesn’t factor in the electoral roll, lenders themselves use it to verify details in any application quickly. Not being registered can cause delays.

|

If you’re not eligible to vote in New Zealand, submit ID and address proofMany people living in New Zealand are not eligible to vote, but are still entitled to request credit. The easiest and most effective way to do this is to submit proof of address (a bank statement, electricity bill etc) and a form of ID (a New Zealand driver’s licence is best). As them to add the details – when properly processed the proofs will greatly increase your credit scoring potential.

|

Don’t EVER be later on credit repayments – it will haunt youThis may be obvious, but it’s probably the most important tip to protect your credit score. If you miss one or two payments, the effect can haunt you for years with credit application rejections and/or higher interest rates. You can avoid this by doing the following:

If you’re having trouble keeping up with minimum payments, it’s important to get things sorted out quickly. Contact the lender and ask them to change your repayment schedule – this will help you keep up with repayments. It may or may not affect your credit score, depending on the variation of your repayments, but it’s better to have managed this than have a default on your records. |

Keep your finances separate from anyone you live withLive in a flat and have everyone’s name on the power bill, lease and/or SKY TV account? Well if any of those payments are late, your credit score may suffer. If a flatmate or partner you live with has a poor history of credit, be sure to keep your finances separate. If you’re moving on from your current home, be sure to de-link yourself from all bills and obligations. Don’t rely on anyone else to sort it out for you. If you're a student, you should be extra careful as your fellow flatmates have a high probability of being short of money.

Relationship ended? If your relationship has ended, be sure to de-link your finances. This means cancelling any joint credit card arrangements, joint bank accounts and updating any rental agreement, utilities and subscriptions etc. The accounts will simply transfer to one person. You’ll need to repay any loans you’ve taken out as well, or agree for one person to take on their repayment. |

Ensure all your cancelled services are actually cancelled on your credit reportIf you have cancelled, for example, a credit card or phone contract but it shows up as active on your credit file, contact the provider (i.e. Kiwibank or Vodafone) and get it off there. Too many open credit services could affect future applications.

|

Only make an application when you need creditEvery time you apply for credit, an entry is made on your files. If you apply for six credit cards in six months, it looks like you’re desperate for credit and leads to lenders rejecting you. Only apply when you are certain you want whatever you’re applying for. In summary, be sure to space out applications and only apply for what you actually need.

If you don’t get a credit card with the limit you want, don’t rush to apply for another credit card somewhere else. Accept the card, and use it to build up a credit history so your next application will be stronger. |

Been rejected? Check your credit filesIf you keep applying for more credit after being rejected, you risk ruining your credit files as more and more companies add credit searches to your history. The lender will tell you which credit agency they used, so check the information on file for accuracy. If there are errors, get them fixed BEFORE making any further applications.

You can also ask why you were rejected – they may give a vague or generic answer, but it doesn’t hurt to find out why. |

Got bad credit? Start rebuilding your history with a credit cardYou probably won’t qualify for a credit card issued from a bank, but cards issued by GEM Finance and QMastercard have lower eligibility criteria. They also have much higher interest rates – currently over 25% per annum. To rebuild your credit rating, you’ll need to repay the balance in full every month on time. If you miss a payment, your credit history will worsen. Even if you spend $50 and repay it, this shows positive credit behaviour and after a few months your credit profile will improve.

|

Apply for credit with precision timing by waiting for “bad stuff” to clearMissed payments, defaults and other unfavourable marks stay on your credit report for up to five years. If you hit a rough patch four years ago and your credit history reflects that, it is better to wait for the information to fall off. Check your credit file to know what lenders will see and you’ll have the best chance by waiting for your record to be clean.

|

Payday loan and quick finance applications are harmful to your credit fileIf you’re planning to apply for a mortgage, it’s a good idea to avoid payday loans. A potential mortgage customer with a history of payday loans is a strong indication of poor money skills. But it’s not just mortgages; credit cards are unsecured debt and providers will be nervous if you’ve got a payday loan history. The risk is similar if you’ve used quick finance options.

|

Credit files favour stability and consistencyHad the same job for six years and owned your own house for four? You’ll automatically be preferenced for credit over renters who move around frequently and change jobs often. Be sure to be consistent in every application – use the same job title, phone number, salary, assets, outgoings. Our tip is to make a note of this data, so when you enter it every time you apply for credit, you provide similar information.

|

Having a baby, taking time off or facing redundancy? Apply BEFORE big changes occurYou’ll have the best credit file when you’re working, so apply beforehand. This isn’t to say it’s wise to apply for credit you can’t afford, but if you need to re-mortgage or get a personal loan for travel, it’s easier to do this while you’re employed.

|

Make an effort to pay off your debtsAny lender will be able to work out the number of lenders you have debt with. If you have too many loans outstanding, your credit file suffers as you become a riskier borrower. Paying off debts with savings is the best way to boost your profile in the eyes of a lender.

|

Cancel any card you don’t use – this includes store cardsIf you have too much existing credit, it can be a red flag to a lender that you want to get more. If you cancel credit cards, you’ll have a stronger credit and also save money in annual fees.

Store cards, such as Farmers, the Warehouse, Q Card and GEM Finance credit card should also be cancelled if they’re not being used actively. If the store card or credit card has a balance on it, look at a balance transfer credit card to reduce the interest you’re paying on the debt. |

If you’ve defaulted, it’s near-impossible to delete the recordDefaulting on a payment is a big no-no when it comes to keeping a clean credit record. If you see a default on your file and know it’s correct, there’s very little you can do about it other than to wait for 5 years for the record to expire. You may think that you can sort it out later, but it’s very difficult to remove a record from your file even if you’ve made full payment.

However, if you see a default that’s not correct, you need to challenge it with the lender. These errors can arise from administrative errors (easy to remove, call or email the lender) or from a dispute over whether or not you owed the company money. Whatever the reason, it’s very important to promptly complain to the company who has inserted the default record, and explain why the default record is unfair or incorrect. Be polite, be firm and be sure to mention that you’ll refer the case to the relevant Ombudsman if the default isn't removed.

Which Ombudsman do I use?

|

Everything You Need to Know About Credit Scores

Some credit reference agencies will try to sell you a “credit score” – you can get one for free, and your credit report is more important

While Credit Simple helpfully provides a credit score for free, other agencies offer credit scores as an extra paid service. We take the view that a “credit score” is not a complete representation of your credit quality and ability to get approved. This is because each lender evaluates data differently; for example your application information may have more weight than your credit data for a credit card application when compared to a payday loan application.

Credit Scores - Worthwhile or Worthless?

If you've applied for a credit score from a credit reference agency such as Equifax or Credit Simple, what exactly have you got? Well, firstly you'll get a number. This is anything from 1 to 1000 (in the case of Credit Simple, for example).

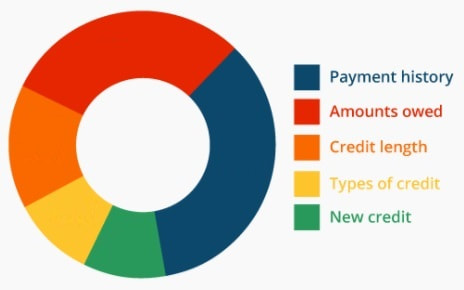

However it's important to keep in mind any application for credit of any form relies on an assessment of three criteria:

A "credit score" misses key application information and will always be based on incomplete information. For example, if you go down to the bank and ask for a mortgage after presenting them with a credit score of 999/1000, they’ll take no notice of it and make you fill out an application with all of your personal financial details. What matters most is affordability.

It’s also important to note that different lenders look for different things, so the score isn’t that important anyway. Your credit score simply is an estimate of how risky you are as a borrower.

While Credit Simple helpfully provides a credit score for free, other agencies offer credit scores as an extra paid service. We take the view that a “credit score” is not a complete representation of your credit quality and ability to get approved. This is because each lender evaluates data differently; for example your application information may have more weight than your credit data for a credit card application when compared to a payday loan application.

Credit Scores - Worthwhile or Worthless?

If you've applied for a credit score from a credit reference agency such as Equifax or Credit Simple, what exactly have you got? Well, firstly you'll get a number. This is anything from 1 to 1000 (in the case of Credit Simple, for example).

However it's important to keep in mind any application for credit of any form relies on an assessment of three criteria:

- Your application details, which covers important details such as salary and your assets, which helps to evaluate whether you can afford what you're applying for. This is a MASSIVE factor in any application, and when you apply for a credit score you don't supply any of those details.

- Any past dealings you've had with the lender. For example, your bank knows you better than a credit agency, as does your mobile provider and credit card company, which is all information that won't be included in your credit score.

- The information contained in your credit report - and it's this information that determines your "credit score".

A "credit score" misses key application information and will always be based on incomplete information. For example, if you go down to the bank and ask for a mortgage after presenting them with a credit score of 999/1000, they’ll take no notice of it and make you fill out an application with all of your personal financial details. What matters most is affordability.

It’s also important to note that different lenders look for different things, so the score isn’t that important anyway. Your credit score simply is an estimate of how risky you are as a borrower.

Should a credit score be ignored then?

Movements in a credit score will come from a range of activity, including opening or closing a bank account, increasing the limit or cancelling a credit card. Lenders will interpret this information differently so none of these examples are necessarily negative, even if they temporary lower your credit score. For this reason, your credit score is only an estimate of where you sit on the credit spectrum. It doesn’t define you at all.

How a credit score affects your financial options

While credit scores don’t provide the full picture, they work to reduce the risk you take on borrowing you can’t afford. We’ve itemised how credit scores affect mortgages, credit cards, loans, phone contracts, utilities and insurance:

- In our view, no - it’s better than nothing and does give an estimate of your creditworthiness.

- If it's lower than you'd like, you can focus on increasing it with positive credit behaviour.

- You can also challenge anything that you don’t agree with to make sure your history is accurate.

Movements in a credit score will come from a range of activity, including opening or closing a bank account, increasing the limit or cancelling a credit card. Lenders will interpret this information differently so none of these examples are necessarily negative, even if they temporary lower your credit score. For this reason, your credit score is only an estimate of where you sit on the credit spectrum. It doesn’t define you at all.

How a credit score affects your financial options

While credit scores don’t provide the full picture, they work to reduce the risk you take on borrowing you can’t afford. We’ve itemised how credit scores affect mortgages, credit cards, loans, phone contracts, utilities and insurance:

- Mortgages – a poor credit score is almost certain to see your mortgage application rejected. This is because you will likely have a history of defaulting. Lending is difficult enough with the strict CCCFA requirements currently in place.

- Credit cards – the better the credit score, generally the higher chance of you being accepted. Your application will decide what card is suitable and the credit limit, but a credit score that suggests you don’t default will be favoured when everything is assessed together.

- Loans – your credit score influences your chance of a loan (personal, car or other) being accepted and what interest rate you’ll pay.

- Phones and Utilities – data from mobile contracts and electrical bills are shared with crediting agencies which makes it really important not to neglect these bills. A missed phone payment or late electrical bill could affect a mortgage application later on. A phone contract is in essence a loan, as you get a phone upfront and pay it off over 12 or 24 months etc. For this reason, credit scores are important.

- Car and home insurance - insurance companies do not check your credit history the way a lender will, but they do want to know your credit background to assess whether or not you can pay the premiums on an ongoing basis.

What Banks and Other Lenders Do With Your Data

We wanted to know what lenders from all over New Zealand do with your data. Specifically, how much data are they sharing, who do they share it with, and how does this affect you?

We asked every major lender (banks and other long-term finance providers) to disclose their credit assessment partners. Firstly, we ask each lender if they engaged in Positive Reporting, i.e reporting the type and amount of credit a customer has received and how repayments are going, as an alternative to only sending "negative" reporting such as missed payments. We also asked who lenders send their customer information to and who they request credit records from - either Equifax (formerly known as Veda), Centrix or ilion. This applied to credit card, personal loan and mortgage applications.

We asked every major lender (banks and other long-term finance providers) to disclose their credit assessment partners. Firstly, we ask each lender if they engaged in Positive Reporting, i.e reporting the type and amount of credit a customer has received and how repayments are going, as an alternative to only sending "negative" reporting such as missed payments. We also asked who lenders send their customer information to and who they request credit records from - either Equifax (formerly known as Veda), Centrix or ilion. This applied to credit card, personal loan and mortgage applications.

Table 1 - Lenders and Data: What Your Bank Knows About You (and Who Else Gets to Know It)

Bank |

Positive Reporting? |

Agency Credit Data Sent to |

Agency Credit Data Requested from |

ANZ |

Yes |

Equifax |

Equifax |

ASB |

Yes |

Multiple* |

Multiple* |

BNZ |

Yes |

Equifax |

Equifax |

Co-Operative Bank |

No |

Won't Disclose |

Equifax |

Heartland Bank |

Yes |

Multiple* |

Multiple* |

Kiwibank |

Yes |

Equifax |

Equifax |

SBS |

No |

Equifax |

Equifax |

TSB |

No |

Won't Disclose |

Won't Disclose |

Westpac |

Yes |

Equifax |

Equifax |

Notes:

* The ASB and Heartland Bank both stated it uses multiple credit agencies when supplying and requesting customer information

* The ASB and Heartland Bank both stated it uses multiple credit agencies when supplying and requesting customer information

|

How to apply for a Free Credit Report:

|

Related Guides

Popular Guides

Buy Now Pay Later Apps

Popular Guides

Buy Now Pay Later Apps