Chasing Debtors and Getting Overdue Invoices Paid - The Definitive Guide

Overdue debtors are frustrating and cause a lot of worry to any business owner. Our guide outlines how to detect a non-payer, scripts to use and legal options to collect your money.

Updated 20 July 2024

Overdue invoices are stressful and time-wasting. To provide the best chance of collecting money owed to you as fast as possible, our guide includes must-know steps to secure your money. Our scripts and guidelines make debtor management easier and more efficient so you can focus on your business. Whether you're a small business or a big one, debtor collection is the same - people who are late on their bills are most likely to be disagreeable.

First prompted by the popularity of an opinion piece in TheSpinoff in early 2018 and subsequent debtor horror stories nationwide, we have put together an all-inclusive guide to minimise late payments and maximise cash collection for any small to medium-sized business. If you have any tips you would like us to include, please contact us via email - we'd love to hear from you.

If you need guidance on cross-border debtor collection and/or customer disputes with regards to goods or services supplied, this guide is not for you. If you are concerned about a chargeback, our chargebacks guide has you covered.

First prompted by the popularity of an opinion piece in TheSpinoff in early 2018 and subsequent debtor horror stories nationwide, we have put together an all-inclusive guide to minimise late payments and maximise cash collection for any small to medium-sized business. If you have any tips you would like us to include, please contact us via email - we'd love to hear from you.

If you need guidance on cross-border debtor collection and/or customer disputes with regards to goods or services supplied, this guide is not for you. If you are concerned about a chargeback, our chargebacks guide has you covered.

Our guide outlines:

- Step One: Vetting a Potential Customer

- Step Two: Protecting Yourself with the best Terms & Conditions and Business Processes

- Step Three: Investing In A Cloud Accounting System

- Step Four: Scheduling Timely Reminders with Ultra-Friendly Scripts

- Step Five: Making the Right Calls to Collect Money

- Step Six: Using Threats that Mean Business and get Results

- Step Seven: Small Claims, Debt Collectors and/or Hiring A Lawyer - What to do if you just can’t get paid

- Avoid Common Debt Collecting Fails

- Debtor Collection Software And Apps

Step One: Vet a potential customer fully

Ask your network and use Google to make a case fileAsking locally and following these basic steps will help create a better picture of the customer you plan to take on.

|

Sense Check the business - are you dealing with someone who can pay you?By sense checking the business, you are really asking if the company you plan to work with "makes sense". Specifically, does the business sound like something that would be profitable? Does it provide a service that would actually find a customer? You have the right to ask what the business does; here are three recommend questions to ask the business owner/contact:

|

Is the phone number trustworthy?

|

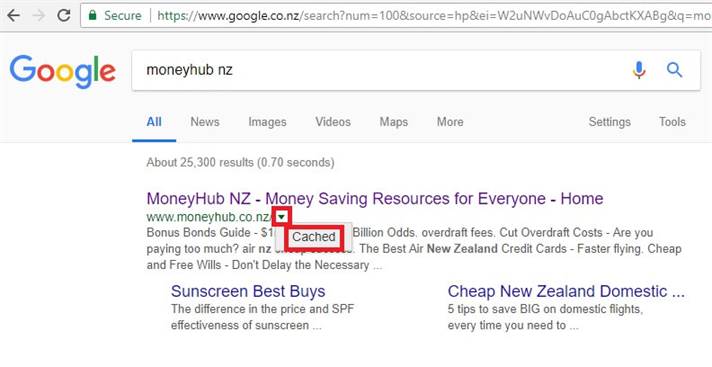

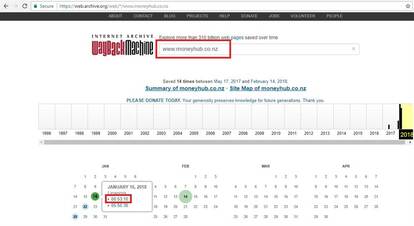

Search using the Google "cache" and perform an "archive.org" search

|

Step Two: Protect yourself with the best terms and processes for every new customer

Ensure your due date is reasonable, but also in your favourStandard terms in New Zealand are 30 days. Most companies pay accounts on the 20th of every month. Don't back down if you believe 30 day terms are reasonable. Customers may say their payment terms are 60, 90 or even 120 days but you do not need to agree to this. If they're serious, they will agree to the terms.

|

Ask your customer about their payment cyclesIt’s essential to know when you can expect to be paid. The New Zealand standard is for payments to be made on the 20th of every month, but this tends to be for larger companies. Small and medium sized businesses tend to pay sporadically; this could be daily, weekly or whenever they want. For this reason, it’s very important to document the payment cycle and use this for later reference if your invoice remains unpaid.

|

Don’t rule out asking for a depositDeposits are perfectly reasonable in industries such as creative, professional services, construction and health. Don’t risk being caught out by non-payment or late-payment. If you have solid credit standing yourself, meaning there is little risk your own business will fail in the short term, you can consider asking for a deposit on a case-by-case basis. Don't be afraid to do this - if customers are serious, they'll pay upfront. Not all industries conform to deposits, but it's worth a shot if your customer says they're serious.

You can also break up the project into milestones, accepting 10-25% per milestone completed. This helps your cashflow while delivering the goods or services to the customer as promised. |

Ensure you get a purchase order or written confirmation for every good or service providedIf you have a purchase order from the company, there can be no disagreement later about the order lacking “approval” or “authority”. Your purchase order is confirmation that the company has engaged you. Without it, they can always say they didn’t engage you and therefore deny payment.

|

Make payment terms and options unapologetically clear on your invoiceDon’t refrain from telling customers when your money is due. Use big letters and numbers, with sections like “PAYMENT DUE 30 DAYS FROM INVOICE DATE” and “LATE PAYMENT TO BE PRE-ADVISED”. If a payment is going to be late, make it clear you need to be notified. If you don’t get paid on time, then your customer is already on the back foot and you’re well within your rights to passively chase it from day 1. You can suggest a payment plan (see more below) if full payment is no longer an option.

To ensure steady cashflows, we recommend having multiple payment options available on the invoice:

|

Issue invoices promptly after goods or services are deliveredDon’t sit around waiting, issue an invoice as soon as your goods or services have been provided, or before if you’re asking for a deposit. Time is money, and waiting to send an invoice in most cases makes no sense at all. Email, express mail or drop it off in person - whatever you need to do, do it as soon as possible.

|

Consider discounting for early/upfront paymentsMany utilities do it, but early payment discounts can be popular if you need invoices paid as soon as possible. Something like 5% is reasonable, and it’s usually easy to handle early discounts on your accounting system. You can selectively use the discount too – it doesn’t need to apply for every customer, just the ones you want or need to pay on time.

|

Ask for the contact details of the person who controls the purseDon't be left in the cold under a pile of invoices. Establish a relationship with your Customer contact as well as the person paying your invoice - they are often different people unless it's a sole trader. A direct email is the best way to sort things out - if your invoice is sent to your contact, he or she will have to forward it to the person paying it. Avoid the hassle and risk of late payment by confirming the contact details of the person who controls the purse.

|

Write a "Terms and Conditions" to protect your businessWhen your business offers credit for the payment of goods or services, you’ll need to have a robust set of terms and conditions to be protected should payment drag out. By having a clear set of terms and conditions, you and your customer understand their rights and obligations. Essential terms and conditions include:

Q: What kind of “terms and conditions” should I have for trade credit? A: Terms and conditions must cover issues such as trade credit, specifically covering issues around invoices, payments and debt collection. Specifics on credit limits and the ability to cancel any agreement should also be included. The more specific your terms are, the less misunderstandings you’ll have later on should there be an issue with payment. A watertight template that sets out credit account terms and conditions is a good starting point if you haven’t formalised credit terms in the past. Your terms and conditions run alongside the terms you have for the sale of goods or services to provide extra protection. Q: What do I do if my credit terms are breached? A: If a customer fails to pay you on time or breaks the terms and conditions, you can contact them to notify them of the specific breach if you want to "get legal". However, in most cases it's much friendlier to simply send an email highlighting your invoice has not being paid within the set time and request acknowledgement of the balance overdue. Ensure you do this promptly and keep it friendly. Our chasing payment scripts below take you through an efficient process. |

Don’t forget, mistakes happen!The accounts payable team may be short-staffed, your invoice was accidentally overlooked and/or your customer is waiting for approval for payment from the CEO. Whatever the reason, don’t despair – just use the reminder emails (outlined below) as a first base for collecting money. Any mistake will be quickly remedied, resulting in your invoice being paid.

|

Spend the time investing in customer relationshipsDo you or someone in your office have a spare few hours? Investing in your business relationships is rarely done by small businesses, but it makes a big difference when it comes to customer retention and payments.

|

Step Three: When it comes to ongoing management, consider investing in a cloud accounting system

Cloud accounting systems are here to stay, and are defining how business is doneIf you’re still running a desktop accounting system it may be time for a change. Creating invoices on a template, posting invoices, manually reconciling payments and working out GST can take much longer manually when compared to an online-based accounting system. They tend to be quite easy to implement and the majority of users save time from day one - cash management and collection is also a lot easier.

What does this mean for debtor collection? When it comes to chasing late payers, you want that process to be as painless as possible. A cloud accounting system isolates who your late payers are, and by how much, all in one click. This means you can turn your attention to the biggest and/or oldest debtors without sifting through a sea of papers. A cloud system will in all but unusual circumstances save a lot of time when it comes to debtor management. You will be able to send statements and re-send invoices in seconds, and have an up-to-date position of your accounts receivable 24/7. In summary, it makes collecting your money significantly easier. So, is a cloud accounting system suitable for your business? Pros:

Cons:

How Much? Popular options include Xero, MYOB and Reckon One and fees start from around $20 + GST per month. |

Step Four: Schedule timely reminders, and be sure to use a friendly script

Send the right script that makes it easy to paySchedule timely reminders, and be sure to use a friendly script:

|

Template: Friendly Debtor Follow Up

Subject: We know you're busy

Hi [Contact First Name],

We know you’re busy and you may have missed our previous emails. This is just a friendly reminder that you have an overdue account with us.

The overdue account relates to [Insert 2-15 words on the purpose of the account]

Not to worry - it's very easy to get up to date, and everything you need is outlined in this email.

Firstly, if you've not received your invoice by email, then please let us know by replying to this email and our Accounts team will send it over.

If you do have it, that's great. There are three ways to make payment.

1. Credit Card (Preferred)

If you wish to pay by credit card, please refer to your original invoice that was sent, which contains a link to "Pay Online Now". This will take you to [Name of Online Payment Processor i.e. PayPal or Stripe etc]

**If you cannot find your original invoice, just reply to this email and we will re-issue it**

2. Bank Payment

Bank Transfer (Bank Name): Name: [Business Name - Account Number: ##-####-########-##

3. Cheque

Please make your cheque payable to [Business Name] + [Full Address]

If you have any questions, please let us know by replying to this email.

Have a wonderful day, and thanks for being a great customer.

Kind regards,

[Business Name] Accounts Team

Subject: We know you're busy

Hi [Contact First Name],

We know you’re busy and you may have missed our previous emails. This is just a friendly reminder that you have an overdue account with us.

The overdue account relates to [Insert 2-15 words on the purpose of the account]

Not to worry - it's very easy to get up to date, and everything you need is outlined in this email.

Firstly, if you've not received your invoice by email, then please let us know by replying to this email and our Accounts team will send it over.

If you do have it, that's great. There are three ways to make payment.

1. Credit Card (Preferred)

If you wish to pay by credit card, please refer to your original invoice that was sent, which contains a link to "Pay Online Now". This will take you to [Name of Online Payment Processor i.e. PayPal or Stripe etc]

**If you cannot find your original invoice, just reply to this email and we will re-issue it**

2. Bank Payment

Bank Transfer (Bank Name): Name: [Business Name - Account Number: ##-####-########-##

3. Cheque

Please make your cheque payable to [Business Name] + [Full Address]

If you have any questions, please let us know by replying to this email.

Have a wonderful day, and thanks for being a great customer.

Kind regards,

[Business Name] Accounts Team

Use and efficient process to collect overdue billsHaving a procedure for follow-up will save you a lot of time from day 1. Every month you may experience a customer, or a number of customers, making you chase the invoice in a game of cat and mouse. There is no need for that "game" to drag out. With a few simple practices, you can get paid quicker without the awkwardness.

We suggest the following:

With the customer getting multiple messages on phone, voicemail, SMS and email, there can be no excuse for late payment. |

Step Five: Make the right call to follow up – talking on the phone and leaving voicemails

How to Make a Debtors CallIf you're reading this, chances are you have a debtor who refuses to pay. Fear not - the next step is to pick up the phone with urgency. With every call, be friendly and ask "yes" or "no".

Handle yourself well on the phone to ensure the ball remains in your court, specifically following this guidance:

Example conversation: Customer: I can't pay you, we don’t have any money You: Are you expecting payment? Customer: Yes, but not for another week. You: OK, next week you can part-pay the invoice. Let’s start with 30% of the amount. Such a conversation can go in a number of directions, but you’ll need to remain upbeat and confident to extract payment. Anything you agree must be noted down and emailed after the call to affirm the agreement. You will then schedule a series of reminders as the payment date approaches – see our example below. You will invariably hear a lot of excuses, and they never stop coming. Remain calm, don’t lose your temper and act firm – don’t say “that’s a lie” or “I don’t care”, but don’t accept excuses either. Your customer will be a bag of emotions, so work with them and offer part-payment if it’s unlikely you can collect all the money owed in one go. |

Step Six: Use threats that mean business and get results

Ensure your due date is reasonable, but also in your favourIf you’re getting nowhere with an unpaid invoice, don’t give up. We've listed some specific industry suggestions, and this list will grow as we hear from more readers.

|

Additional Suggestions to get paidHave a procedure for follow up to save time. Every month you may experience a customer, or a number of customers, making you chase the invoice in a game of cat and mouse. This can include:

|

Send a threatening debt collection script - our example below can helpWhen the calls have fallen on deaf ears and you just want to be paid, it's time to be firm with direct and actionable threats. We've developed a script below with the help of a number of small and medium-sized businesses. You can edit it to your specific needs and email or post it. You can also hand-deliver it for added urgency.

|

Template: Final Notice of Debt Collection

Subject: Overdue Invoice & Legal Action (Attention Required)

Hello (customer name)

Payment for invoice number [insert] remains unpaid. The balance sits at [insert] as of today.

We are now elevating your case.

This is a notice of impending legal action. If payment is not received by [insert the date in 7 days] days, we will take the following action - I outline the next steps in chronological order, not by order of severity.

Next Steps

If you would arrange payment within the next 24 hours, and within 7 days at the latest, we will cease our course of action. If payment has not been received by the specified date, we will initiate further action and the dissemination of the debt across your credit data.

I have attached the invoice and anticipate your immediate payment.

Regards,

[Your Name]

Subject: Overdue Invoice & Legal Action (Attention Required)

Hello (customer name)

Payment for invoice number [insert] remains unpaid. The balance sits at [insert] as of today.

We are now elevating your case.

This is a notice of impending legal action. If payment is not received by [insert the date in 7 days] days, we will take the following action - I outline the next steps in chronological order, not by order of severity.

Next Steps

- Log your default with Dun & Bradstreet in both the company name and your personal name. This has adverse effects on both business and private finance as the data is used by banks, finance institutions, insurance companies and more.

- Log a credit complaint with Equifax - the data we supply will adversely affect your business and personal credit arrangements in the short and long term. Banks, employers, insurers and other lenders may request a credit report in the future and a bad debt notice will put you at a disadvantage for future opportunities.

- Instruct either our lawyer to take the case to the [name of your city] District Court, or pass your balance to our preferred third party debt collector - we will make that call after submitting 1. and 2. above. In most cases, we take legal action as we find this to be the most successful course of action for recoveries. Without prejudice, we may also seek to put your business into administration and/or petition for your personal bankruptcy, both of which we have experience in doing previously.

If you would arrange payment within the next 24 hours, and within 7 days at the latest, we will cease our course of action. If payment has not been received by the specified date, we will initiate further action and the dissemination of the debt across your credit data.

I have attached the invoice and anticipate your immediate payment.

Regards,

[Your Name]

Step Seven: Debt Collectors and/or Hiring a Lawyer - What to do if you just can’t get paid

Before you proceed to legal and/or debt collection options, consider your current situation objectively. You have three choices:

- Try to negotiate the debt: You can do this yourself, or ask a lawyer to assist. The purpose is to give your debtor the opportunity to explain why you remain unpaid. In such discussions, you may enter an arrangement whereby you get a portion of the balance owed that works for both parties.

- Write the debt off: This is not ideal, and it's emotional and frustrating. However, you''ll know your customer better than anyone and can make a judgment as to the probability of getting repaid. If you've heard things about your customer that makes payment unlikely, I may be an option to put the debt down to experience and warn others.

- Recover the debt: We outline the process below. As always, MoneyHub does not offer financial or legal advice - the contents on this section merely present popular avenues for New Zealand businesses seeking to recover money.

Debt Recovery Options

But, you’ll need to have terms and conditions agreed upon by your customer. You’ll also need:

Q: What about the Small Claims Court or the Disputes Tribunal?

A: Contrary to popular belief, the Small Claims Court (also known as the Disputes Tribunal) does not hear or settle debtor cases. In their own words, "debts when the person owing the money agrees they owe the debt but doesn’t pay anyway. In other words, you can’t use the Tribunal as a debt collection agency". The first court available is the District Court.

- Engage a debt collection agency to recover the debt on your behalf

- Call your lawyer and initiate legal proceedings

But, you’ll need to have terms and conditions agreed upon by your customer. You’ll also need:

- Purchase Order(s)

- Invoice(s)

- Proof of delivery

- All and any communication about the order or the debt with your customer.

Q: What about the Small Claims Court or the Disputes Tribunal?

A: Contrary to popular belief, the Small Claims Court (also known as the Disputes Tribunal) does not hear or settle debtor cases. In their own words, "debts when the person owing the money agrees they owe the debt but doesn’t pay anyway. In other words, you can’t use the Tribunal as a debt collection agency". The first court available is the District Court.

Engage a debt collection agencyThere are many debt collection agencies around, all eager to take a slice of your invoice if the debtor pays. Many work on a “no win, no fee” basis but their fees can be high if the debtor does pay. They’ll chase on your behalf, and relentlessly pursue your customer until the debt is settled.

|

Hire a lawyerWorking with a lawyer to recover your debt can be expensive – make sure you ask for all cost estimates up front. If you doubt the debtor can repay the debt, you are probably best not to engage a lawyer as you’ll be stuck with a legal bill if your invoice doesn’t get paid.

What do lawyers do? In most cases, the lawyer will send a standard letter asking the debtor to pay the debt owed. The letter outlines the legal action and late payment charges, as well as interest charges. The letter usually requests payment within 7-10 days. If this does not work, a second letter can threaten insolvency – this means that the company can be wound up if payment is not made. This threat usually encourages payment. If not, you can decide whether or not to begin insolvency proceedings. If an application is successful, the business will be liquidated – you will share the assets amongst other claimants, so the assets of the company may not cover the debt you’re owed. If this is likely, legal proceedings may incur more cost than they realise. |

Avoid Common Fails with our list of "Don't Do" points

10 Don’t Dos:

- Avoid hand written invoices – your bank account and details may be hard to read

- Check the address you’re sending it to – if the customer’s address is 76 Fern Street, don’t send it to 67 Fern Street. It’s a simple error which immediately causes a delay, ultimately costing you time and money and hassling your customer for no reason.

- Avoid “letting the invoice go” – the money is owed to you, and while chasing is unpleasant and seemingly endless, you will get what you deserve with perseverance. Chasing debtors is a way of life for small business owners. If you let one invoice go, you may avoid chasing other debtors later and you’ll potentially risk your own business in the process. Your debtor will also do it to someone else - it's not fair to anyone.

- Don’t agree to a discount on the invoice unless you’re certain you won’t be paid otherwise – it’s all very easy to take a cut when you’re desperate, but you’ll be on the back foot for further negotiations and when you shouldn’t be. Be firm, and you’ll have the highest recovery on the debt owed.

- Don’t delete any emails from the customer – every conversation may impact your ability to collect later on an invoice. If the customer gave permission over email for extra work and has now changed their mind after work has been complete, your email is proof you have a right to collect. If you’ve got storage issues, move to Google Apps ($5/month) or a Gmail account (free) which offers up to 15GB of storage.

- Don’t delay to any emails or calls about payments – if your customer has responded to your payment request, do not delay in responding. Communication about an unpaid invoice should be next priority, and a prompt response will minimize the drag of your bill being unpaid. If it means getting on the phone instead of holding an internal meeting, do it.

- Don’t use antiquated accounting methods – make sure you have online banking (hard to believe, but some businesses don’t use it), download the bank’s app to your phone, make sure your accounting entries are up to date when it comes to debtors and consider setting up SMS alerts when deposits are made into your business account. This way you’ll have 100% accurate information when talking about any debtor. You may have an accounts person, but cash collection ultimately rests on the business owner to manage if the standard procedures fail to extract payment from a troublesome customer.

- Don’t’ agree to a payment plan unless it’s realistic - If your invoice is $500 and the customer wants it now repaid over 24 months (at ~$20 month), it’s best to reject such plan outright, and instead suggest “$500 over six months, with two months up front”.

- Don’t feel bad about putting pressure on a customer to settle their debt - If you continue to be ignored, you’ll need to step up the chase to get paid. Getting paid is merely part of the contractual relationship. Had you taken a customer’s money and not delivered the good or service, that customer would be chasing you. You’ve agreed to be paid by a certain date and putting pressure on the customer to pay is in line with the contractual terms.

- Don’t ever forge legal letters – if you don’t like a lawyer’s quote, don’t be tempted to do a DIY legal threat. Impersonating a lawyer is a criminal offence and bad debtors can also be big squealers.

10 PROVEN methods to effectively collect on an invoice:

- You must confront, and not be afraid to put pressure on. The alternative is no money - you won't be paid if you give up. Yes, it's exhausting being given the run-around and lied to, but confrontation is the key. The person who owes you money is in the wrong - it's ugly to do, but confrontation and physical presence is key.

- Take photo of person not paying you. This sounds passive-aggressive, but it does work. If your debt is dragging out and you’re getting the run-around and know you’l never work with them again, notify your customer that you will be photographing them.

- Bring a friend to offset your "bad cop". You'll need someone to play the "good cop" as after any confrontation to make the act of paying easier; the debtor may have a problem physically paying you if things have reached boiling point.

- If you only want to accept cash up front, make it clear and unapologetic. Signage such as "Please do not ask for credit as refusal often offends" is perfect for a small business with lots of small-sized customers.

- If a payment plan has been agreed, make it clear you’re watching your account and anticipating the money. We suggest a series of follow ups like the below:

- 1 week before payment due: Hi (customer name). Just a quick note to say we’re expecting payment of [$] on 20th March for invoice ### – thanks for your prompt attention to this overdue invoice”

- 1 day before payment due: Hi (customer name). Just a heads up on your payment of [$] tomorrow for invoice ### – our accounts team is anticipating it before close of business, thanks for your prompt attention to this overdue invoice”

- Day payment is due: (if payment not received): Hi (customer name), payment has not been received pursuant to our agreed payment plan. We expect payment tomorrow at the latest - if no payment is received we will be elevate your case to our lawyer and initiate credit report filings. [If the customer continues to avoid payment, use the script suggested here]

- Day payment is due (if payment received); Hi (customer name). Thank you – we confirm receipt of [$] for invoice ###, the balance remaining is [$] with the next payment due [date].

Worth Mentioning: Debtor Collection Software and Apps

- Xero lists a number of debtor apps which help you chase late payments automatically - you can review these here.

- Please note, most apps charge an additional monthly fee above your existing Xero subscription.

Related Guides

Do you have a tip we don’t know about? Please get in touch. Debtor collection is a complicated business and we would love to know your personal experiences and success.

- How to Make Payroll (When You're Short of Cash)

- 10 Money-Saving Tips For Businesses

- Business Insurance

- Public Liability Insurance

- Business Credit Cards

- Business Loans

- Domain Name Registration Fees

- Business Loan Calculator

- ROI Calculator

- Percent Off Calculator

- Profit Margin Calculator

- Current Ratio Calculator

- Quick Ratio Calculator

Do you have a tip we don’t know about? Please get in touch. Debtor collection is a complicated business and we would love to know your personal experiences and success.