Q Card & Q Mastercard Review

Thinking of applying for a Q Mastercard? Do you have a Q Card already? We comprehensively review both Q cards and outline fees, penalties, interest rates and limitations.

Updated 16 June 2024

Summary of Q Card

Summary of Q Card

- Q Card offers generous interest-free and payment holiday periods on purchases, but to avoid higher-than-credit-card interest rates, the balance due MUST be paid off before the end of the interest free period.

- The Q Card effectively combines a traditional "store card" with "hire purchase" by being accepted at thousands of shops all over New Zealand.

- The true cost of "interest free" is not $0. You'll need to pay upfront setup fees and annual account fees.

- The standard interest rate is 28.50% p.a, and a number of fees apply to the card which can make it an expensive finance option if you already have trouble paying bills on time .

- At least 160,000+ New Zealanders have one; its closest competitor is the GEM Card.

- In 2016 Q Card's owner FlexiGroup introduced the Q Mastercard. This operates similarly to the Q Card with the added benefit of global acceptance in any retailer accepting Mastercard. We have reviewed the Q Mastercard in addition to the Q Card, as no new Q Cards have been issued since August 2016. Existing Q Card holders can continue to use their Q Card as normal, or choose to upgrade to a Q Mastercard account.

Our Review

In this guide, we outline the way a Q Card works, the fees, interest and default fees a cardholder is subject to, an overview on in-store and online purchases, as well as tips for best use. We also outline the Q Mastercard, which operates in a similar way to a Q Card with regards to interest-free offers, fees, interest rates and insurance.

Please note: MoneyHub is not a Financial Adviser, and this guide has been published to outline the positive and negative features of using a Q Card and Q Mastercard as a means of making purchases.

What We Cover

In this guide, we outline the way a Q Card works, the fees, interest and default fees a cardholder is subject to, an overview on in-store and online purchases, as well as tips for best use. We also outline the Q Mastercard, which operates in a similar way to a Q Card with regards to interest-free offers, fees, interest rates and insurance.

Please note: MoneyHub is not a Financial Adviser, and this guide has been published to outline the positive and negative features of using a Q Card and Q Mastercard as a means of making purchases.

What We Cover

Q Card - the Basics

- You can only use Q Card at over 6,000 “partner” stores NZ wide. These stores include everything from groceries to fuel and everything in between. Examples are JB HiFi, Countdown, Mobil, etc.

- There is a standard interest-free and payment holiday period of 3 months. This means purchases made will not require a payment or incur interest until the end of the third month after their purchase. However, many merchants accepting Q Cards offer specific Long Term Finance deals which can extend the interest-free term to 12, 18 and even 24 months on certain eligible purchases.

- Monthly minimum repayments are either 3% of the balance owed, or $10 (whichever is greater).

- Q Card was previously owned by Fisher & Paykel Finance Ltd. In 2015 this changed when FlexiGroup, an Australian company, purchased the business. We have not noted any changes in the operation of Q Card since this happened, other than the introduction of the Q Mastercard, which we review below.

Q Card: Claims & Reality

We Examine the Claims made by Q Card:

Claim 1 - "Q Card Is Welcome At Thousands Of Stores Around New Zealand"

Is it True?

Yes. There are numerous retail partners who accept Q Card as a form of payment. These include House of Travel, Mitre 10, JB HI-FI, Rebel Sports, Briscoes, Lumino Dentists etc.

Claim 1 - "Q Card Is Welcome At Thousands Of Stores Around New Zealand"

Is it True?

Yes. There are numerous retail partners who accept Q Card as a form of payment. These include House of Travel, Mitre 10, JB HI-FI, Rebel Sports, Briscoes, Lumino Dentists etc.

Claim 2 - "(Cardholders) enjoy 3 months no payments and no interest on every Purchase made with your Q Card in store or online. And there’s no minimum spend!"

Is it True?

Yes. Q Card offers the 3 month term as standard on any purchase. No exceptions.

Is it True?

Yes. Q Card offers the 3 month term as standard on any purchase. No exceptions.

Claim 3 - "Q Card offers access to Long Term Finance deals in-store at thousands of participating retailers throughout New Zealand".

Is it True?

Yes. Beyond the standard 3 month term, retailers can offer interest-free periods of up to 24 months. It is retailer and offer-specific; understand that if you see a "12 months interest free with Q Card" deal in one store, it may not apply in another.

Is it True?

Yes. Beyond the standard 3 month term, retailers can offer interest-free periods of up to 24 months. It is retailer and offer-specific; understand that if you see a "12 months interest free with Q Card" deal in one store, it may not apply in another.

Q Card - 14 Essential Must-Knows

Paying off a Q CardQ Card “flexi payment plan” or Long Term Interest Free: the purchase you make has an ongoing requirement for minimum monthly repayment once the payment holiday and interest-free period is over. A customer can pay as much or as little as they choose, with 3% or $10 (whichever is greater) being the minimum requirement. This means that you’ll be paying interest on the 97% of the balance that isn’t repaid (should you choose to only pay the minimum due).

Payment options

Q Card offers five ways to make payments:

|

Everything you buy is entitled to three months interest free, with no repaymentsThis is the standard offering from Q Card. It's a generous deal which is financially savvy if you can pay off your balance in full when it's due. No credit card offers such generous terms, and the GEM Finance credit card only kicks in on purchases over $250.

If you can't pay off the balance, you'll be paying an interest rate of 28.50% p.a. until you clear it. To put it in dollar terms, if you have a $4,000 balance owing after the three months interest free period, you'll pay $85 a month in interest in the first month and it will then decrease every month as you pay down the balance. New purchases on the card will be entitled to the interest-free period. We talk about interest in detail in point 4 below. |

You'll repay the balance of your Q Card at a minimum of 28.50% p.a, and it's added to your bill dailyIt's important to understand the interest rates charged by Q Card - they're almost twice as high as a low interest credit card and keep you in debt unless used wisely.

Interest Rates

Interest is charged daily Q Card charges interest on any purchases that have not been repaid before the end of their interest-free period. The standard 28.50% p.a. interest rate applies to the remaining balance at the end of the interest-free period. The interest on Q Card is per annum, this means that it is accrued at the annualised rate. If you have trouble paying bills, read on: MoneyHub has a real concern that Q Card’s low 3% minimum payment amount, coupled with its high interest rate, could keep cardholders in debt far longer than what they might expect. Specifically:

|

Miss a Payment and FEES will applyQ Card has a number of fees when it comes to defaults. We've made them clear below so cardholders know what they could pay if things go wrong:

Default Fees

|

Q Card also charges annual fees, as well as other account feesThere are a number of account and administration fees, outlined below:

The True Cost of Interest Free It's important to keep in mind the true cost of "interest free" is not $0. You'll need to pay upfront setup fees and annual account fees. For example:

|

Q Card charges fees for non-standard servicesWe've included the fees and free services that apply for non-standard requests and services:

|

When you make a payment, it’s is apportioned to pay off your interest-incurring purchases firstQ Card operates an "order of priority" when you make a payment. To outline where a payment goes, we’ve list the order below.

Example:

|

Financial Hardship? Q Card is legally obligated to assess your situationIf you find yourself struggling to meet or keep up with payments, you’re legally entitled to apply for a "financial hardship" consideration. This lets you inform Q Card about your financial issues and how repaying your balance is causing financial difficulty. Our debt help guide has more information and sets out template letters for such applications.

|

You’ll be charged fees even if you don’t have a balance to payAs Q Card is a revolving credit facility, you'll be charged $25 every six months for the administration of the facility. This annual account fee is payable even if you don’t have a balance owing. Fees are also subject to a 28.50% p.a. interest rate as well as arrears fees for non-payment, so make sure to pay 100% of the amount when it appears on your closing balance.

|

Most banks’ Balance Transfer credit cards accept Q Card balancesThe good news is that if you’re stuck in a cycle of 28.50% p.a. interest rates on balances that never seem to clear, our guide to balance transfer credit cards outlines the best offers currently available. You’ll need to apply with a bank you’re not currently with, and if you get approved, your Q Card balance will reduce by the amount you’ve been approved to transfer.

|

You can pay off the entire balance at no feeIf you want to clear a balance all at once, you can do this without being charged a fee. Q Card requires you to obtain a “Pay Off Quote” over the phone. You can then provide an expected payment date and get an estimate of the final balance. Once paid, your Q Card will have a zero balance.

|

Your balance owing can go ABOVE the set credit limitIf interest charges and/or fees are made to your account while the balance is at or near to the credit limit, your credit limit can be exceeded. Q Card does not charge a fee for breaching the credit limit, but it also means purchases will be declined until payments are made to bring the balance below the credit limit.

|

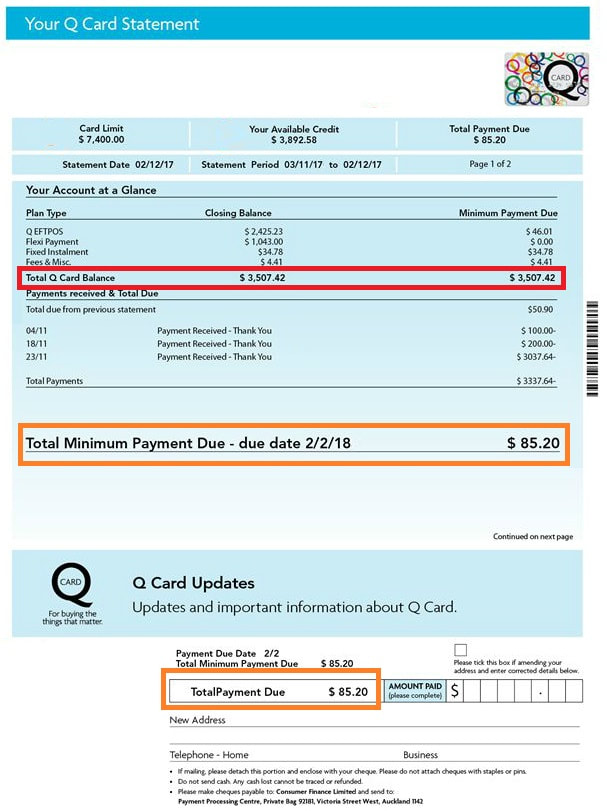

Interpreting a Q Card statement – what you need to know

The largest font on the Q Card statement refers to the "minimum payment due" (indicated in orange), but it's important to know that you'll pay interest on the amount of that no longer has Interest Free terms of the "closing balance" (indicated in red above) you don't repay.

Let's see how this works.

Your "total balance due" is calculated in the following way:

What We Think

Let's see how this works.

- In the example above, if only the minimum payment of $85.20 is made, then the remainder of the closing balance would be $3,422.22.

- With the Q Card interest rate set at 28.50% p.a., the interest charge for the month will be $74.11

- For this reason, the "minimum balance due" poses a risk of keeping cardholders in a debt trap.

Your "total balance due" is calculated in the following way:

- Fixed Installment Plans Balances: These require the set monthly installment amount as specified on the Fixed Installment Contract. If you've purchased something and you agreed with the retailer to repay it in fixed amounts, this is what you'll see. i.e. You bought a $2,400 TV and agreed to repay it at $200 every month for 12 months.

- Flexi Plans that have come out of the payment holiday period: If you've used your Q Card for purchases with the standard "3 months interest free/no repayments" terms, you are required to pay at the minimum 3% of the total balance due. For example, if you bought a $2,400 TV with 3 months interest free/no repayments, on month 4 the closing balance would be $2,400 but your minimum payment due would be 3% of this, approx $72.

- Fees & Miscellaneous: Cardholders are required to repay the full amount of the fees balance each month

What We Think

- As with any credit card, paying off more than the minimum balance will reduce interest costs in the short and long term.

- Q Card has historically received millions in interest charges every year - if you're unlikely to be able to repay the balance, consider a balance transfer credit card - you can move Q Card debt to 0% deals for up to 12 months.

Q Card Stores and Retailers

Q Card is accepted at thousands of stores all over New Zealand. The best indication of the range of retailers is found on the QCard Storefinder.

Q Mastercard

Q Mastercard works in the same way as a Q Card, with several additional benefits:

With those benefits come two additional fees:

Q Mastercard, like the Q Card, is eligible for specific deals promoted by Q Card which can extend the interest free term on certain eligible purchases.

- A Q Mastercard has a Standard Interest Rate of 28.50% p.a. at the end of the interest free period.

- A Q Mastercard will be accepted as a method of payment anywhere Mastercard is accepted. This means you can also use it overseas, whereas the Q Card is only accepted as participating retailers in New Zealand. All purchases, including those at non participating retailers in New Zealand and overseas, are three months interest free, with no repayments.

- You can withdraw cash on your Q Mastercard (this is not possible with a Q Card). However the cash advance interest rate of of 29.50% is applicable from when the withdrawal is made.

With those benefits come two additional fees:

- International Transaction Fee - 1.4% of the total of the converted balance to New Zealand Dollars (which are converted at a rate of exchange fixed set by Mastercard). The fee is charged by Mastercard directly.

- The Cash Advance Rate - 29.50% p.a. applies to the withdrawal amount; there is $2 domestic or $3 international Cash Advance Fee.

Q Mastercard, like the Q Card, is eligible for specific deals promoted by Q Card which can extend the interest free term on certain eligible purchases.

Q Card and Q Mastercard - Our Conclusion

- If you have a history of paying off credit cards, a Q Card or Q Mastercard can be a useful addition to your wallet. But make sure to tick the "Pay Closing Balance" box on a direct debit form to avoid any interest charges.

- If you have trouble paying bills on time, you will probably want to avoid the Q Card The Q Card Standard Interest Rate is above-market (28.50% p.a.) and you could easily find yourself stuck paying barely more than the interest charges on a month to month basis.

- We are cautious of supermarket retail partners, including Countdown, New World and PAK'nSAVE, offering Q Card deals - similar to any credit card, we take a view that buying groceries with 3 month interest free deals could be more expensive if the purchases are not paid off when they are due.

- The number of merchants offering interest-free deals beyond the standard 3 months is significant.

- Cardholders should remember that the retailer offering an interest-free deal may not be the best deal overall. We suggest you shop around and avoid limiting yourself to Q Card retailers. For example, an outdoor furniture set bought at a non-Q Card retailer may be cheaper upfront.